Can I switch mortgage lenders after locking my loan Lenders can’t charge a separate loan origination fee on an SBA guaranteed loan. Lenders can charge “packaging fees” but the fees must be reasonable and customary for the services actually performed and must be consistent with those fees charged on the lender’s similarly-sized non-SBA guaranteed commercial loans.

Closing Costs Are you paying too much?

Understanding Lender Fees and Other Closing Costs. According to Bank.com, the credit report fee can cost $25 to $100, while the general mortgage application fee can cost as much as $500, depending on the lender. Closing Costs The closing is the meeting where you meet with representatives of the lender and the title company to sign loan papers., Nov 17, 2014 · Tell the lender you want to cancel the pending application and provide a reason. Explaining the situation will help the lender understand any future needs. Next, go through your application and existing agreement with your lender. Typically, you can get refunds of certain fees, such as credit check and appraisal fees..

Application Disclosure Form when you receive your Loan Estimate. A broker must provide you with a “Broker Services Agreement,” which is a separate document. Fee amounts actually charged by a lender and any broker on your loan are on page 2 of this Form. Note that a lender and broker may not both charge an application fee. Permissible fees are: The origination fee is an upfront fee charged by lenders for processing a new mortgage loan application. Basically it is the commission the lender/loan officer receives for putting together and processing your mortgage. The loan origination fee is expressed as a percentage of the loan amount, typically between 1% – 2% of the total loan amount.

Home Loans with no application fees know that even if a home loan has an application fee, in many cases you can seek a waiver from your new lender. but will charge an annual fee which can May 01, 2019 · When you get a student loan, the lender may also charge different types of student loan fees that can either cost you more money or reduce the amount of …

Jul 09, 2016 · Here are the key ways you can minimize this fee on your home loan. Advertiser Disclosure. So proposing a 0.5 percent origination fee of $2,500 on the bigger loan amount is one way to negotiate that charge: You get a lower fee, and the lender earns more than he would on the average origination fee of the average loan balance. Oct 16, 2019 · An origination fee is a fee you pay to your lender when you receive funds. The charge compensates your lender for expenses like processing your application and marketing. Fees typically range from 1% to 8% of the amount you borrow, although you might pay a flat fee or nothing at all, depending on the lender.

Read your application and initial disclosure documents carefully. Look for the circumstances under which an application fee is refundable. For example, a bank may collect the fee to cover expenses in case a loan is declined, but will refund the fee if the loan is approved and you move forward. The origination fee is an upfront fee charged by lenders for processing a new mortgage loan application. Basically it is the commission the lender/loan officer receives for putting together and processing your mortgage. The loan origination fee is expressed as a percentage of the loan amount, typically between 1% – 2% of the total loan amount.

Mar 18, 2019 · The lender must send out the Loan Estimate within three business days of receiving your application. The Loan Estimate is a curious document. the lender can charge a fee to obtain a credit The processing and underwriting fees vary from one lender to another. These are not similar actually. The former is charged for processing the loan and the latter for analyzing the risk involved in giving you the loan. You can negotiate with the lender regarding the processing fee as …

Lenders can’t charge a separate loan origination fee on an SBA guaranteed loan. Lenders can charge “packaging fees” but the fees must be reasonable and customary for the services actually performed and must be consistent with those fees charged on the lender’s similarly-sized non-SBA guaranteed commercial loans. Read your application and initial disclosure documents carefully. Look for the circumstances under which an application fee is refundable. For example, a bank may collect the fee to cover expenses in case a loan is declined, but will refund the fee if the loan is approved and you move forward.

In order to meet this definition, total upfront points and fees may not exceed 3% for loan amounts of $100,000 or more. This essentially limits what a lender can charge in the way of fees, though it’s still fairly accommodating. If lenders don’t care to meet the QM rule, they can … Don’t leave out lender fees. Lenders charge loan costs, like origination and underwriting fees. If you can get an estimate before you submit your application, try to get a few different Loan

Jul 09, 2016 · Here are the key ways you can minimize this fee on your home loan. Advertiser Disclosure. So proposing a 0.5 percent origination fee of $2,500 on the bigger loan amount is one way to negotiate that charge: You get a lower fee, and the lender earns more than he would on the average origination fee of the average loan balance. Once you receive a Loan Estimate, it's up to you to decide whether you want to proceed with that particular lender and that particular loan application. If you have received your Loan Estimate and you tell the lender that you want to proceed, then the lender can charge you additional fees. For example, lenders commonly charge an application fee

(d) You may charge a nonrefundable rate lock fee when agreed to in writing by the borrower. The fee may be retained if the borrower breaks the rate lock agreement and you are making the loan, if you have paid a third party for the interest rate lock, or if you have otherwise made a financial commitment to protect the rate during the lock period. Simply put, this is a fee for processing your loan application. It can be pretty easy to find lenders who don’t tack on origination fees, but those that do charge them tend to charge between 1% and 8% of the loan. There are two ways an origination fee could alter your loan: The lender may add it to your principal

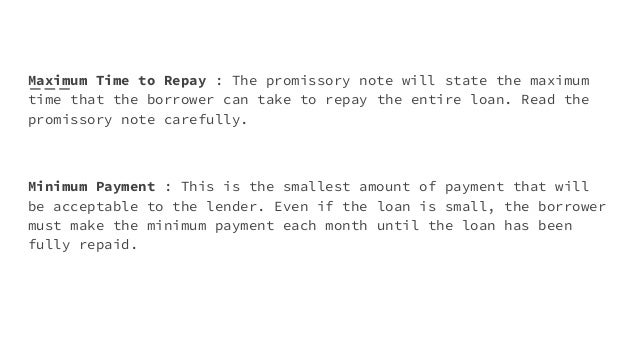

May 01, 2019 · When you get a student loan, the lender may also charge different types of student loan fees that can either cost you more money or reduce the amount of … The APR shows you the total cost of a loan, including all fees, so you can fully understand which loan works best for you. What is an application fee? An application fee is a cost a borrower must pay when applying for a loan. It is meant to pay for the process of approving a loan.

Aug 14, 2019 · The SBA 504 loan doesn’t have a specific guarantee fee like the 7(a) loan does, but it does have standard loan fees similar to the guarantee fee associated with a 7(a) loan. These standard fees are about 3% to 3.5% of your loan. This fee, like the guarantee fee of the 7(a) … In order to meet this definition, total upfront points and fees may not exceed 3% for loan amounts of $100,000 or more. This essentially limits what a lender can charge in the way of fees, though it’s still fairly accommodating. If lenders don’t care to meet the QM rule, they can …

List of Non-Allowable Fees on VA Home Loans. Six Sure Signs of an Advance-Fee Loan Scam. Some red flags can tip you off to scam artists’ tricks. For example: A lender who isn’t interested in your credit history. A lender may offer loans or credit cards for many purposes — for example, so you can start a business or consolidate your bills., May 23, 2018 · In Short: A loan origination fee is an upfront charge paid to the lender at closing. It covers the service they provide during the loan approval process. Origination fees are usually between 0.5% and 1% of the loan amount..

Application Fees Bankers Online

3 Ways to Avoid Paying a Loan Origination Fee for Your. In order to meet this definition, total upfront points and fees may not exceed 3% for loan amounts of $100,000 or more. This essentially limits what a lender can charge in the way of fees, though it’s still fairly accommodating. If lenders don’t care to meet the QM rule, they can …, Fees for required service that the lender did not allow you to shop separately for, when the provider is not affiliated with the lender or mortgage broker; Transfer taxes; Costs that can increase by up to 10 percent. If there is a “change in circumstances,” these costs can change by any amount..

How to Terminate a Purchase Mortgage Agreement. Mar 18, 2019 · The lender must send out the Loan Estimate within three business days of receiving your application. The Loan Estimate is a curious document. the lender can charge a fee to obtain a credit, The origination fee is an upfront fee charged by lenders for processing a new mortgage loan application. Basically it is the commission the lender/loan officer receives for putting together and processing your mortgage. The loan origination fee is expressed as a percentage of the loan amount, typically between 1% – 2% of the total loan amount..

Advance-Fee Loans FTC Consumer Information

3 Ways to Avoid Paying a Loan Origination Fee for Your. Simply put, this is a fee for processing your loan application. It can be pretty easy to find lenders who don’t tack on origination fees, but those that do charge them tend to charge between 1% and 8% of the loan. There are two ways an origination fee could alter your loan: The lender may add it to your principal https://en.m.wikipedia.org/wiki/Paperless_loan Processing fee: A processing fee is simply to cover the cost of processing the documentation related to your mortgage application. The processing fee can be between $300 to $1500. Commitment fee: The lender can charge a borrower a commitment fee to keep a line of credit open, or to guarantee a loan for a future date. In many cases, borrowers.

Application Disclosure Form when you receive your Loan Estimate. A broker must provide you with a “Broker Services Agreement,” which is a separate document. Fee amounts actually charged by a lender and any broker on your loan are on page 2 of this Form. Note that a lender and broker may not both charge an application fee. Permissible fees are: Home Loans with no application fees know that even if a home loan has an application fee, in many cases you can seek a waiver from your new lender. but will charge an annual fee which can

This is the margin the lender earns by taking a loan application, arranging the loan, procuring funds and subsequently closing. This fee varies across the board, but it typically runs more than Feb 15, 2016 · The loan origination fee is a charge by the lender for evaluating and preparing your mortgage loan. This can cover document preparation, notary fees and the lender’s attorney fees. Expect to …

Read your application and initial disclosure documents carefully. Look for the circumstances under which an application fee is refundable. For example, a bank may collect the fee to cover expenses in case a loan is declined, but will refund the fee if the loan is approved and you move forward. Simply put, this is a fee for processing your loan application. It can be pretty easy to find lenders who don’t tack on origination fees, but those that do charge them tend to charge between 1% and 8% of the loan. There are two ways an origination fee could alter your loan: The lender may add it to your principal

Related Terms and Acronyms: application fee What the lender charges to process the document in which a prospective borrower details his or her financial situation to qualify for a loan.; late charge A fee imposed on a borrower for not paying on time ; loan Letting another party … Read your application and initial disclosure documents carefully. Look for the circumstances under which an application fee is refundable. For example, a bank may collect the fee to cover expenses in case a loan is declined, but will refund the fee if the loan is approved and you move forward.

Once you receive a Loan Estimate, it's up to you to decide whether you want to proceed with that particular lender and that particular loan application. If you have received your Loan Estimate and you tell the lender that you want to proceed, then the lender can charge you additional fees. For example, lenders commonly charge an application fee Each mortgage lender has its go-to third-party companies to assist with the loan transaction, and the fees they charge are fixed and non-negotiable. These are the services you can’t negotiate: Appraisal fee: The cost associated with determining a home’s value.

Feb 15, 2016 · The loan origination fee is a charge by the lender for evaluating and preparing your mortgage loan. This can cover document preparation, notary fees and the lender’s attorney fees. Expect to … Mortgage Rate Lock Cancellation Fees. by CR Ask Kate about Mortgage Rate Lock Cancellation Fees: Hi Kate, In short, can a mortgage broker have verbal recorded Mortgage Rate Lock Cancellation Fees? Are they binding? They recorded my wife at the start of the loan refinancing process over 4 months ago.

Jul 09, 2016 · Here are the key ways you can minimize this fee on your home loan. Advertiser Disclosure. So proposing a 0.5 percent origination fee of $2,500 on the bigger loan amount is one way to negotiate that charge: You get a lower fee, and the lender earns more than he would on the average origination fee of the average loan balance. Mortgage lenders and brokers charge thousands of dollars in closing costs on every loan they make. A new Bankrate.com survey can help borrowers figure out if they're being charged too much.

Aug 14, 2019 · The SBA 504 loan doesn’t have a specific guarantee fee like the 7(a) loan does, but it does have standard loan fees similar to the guarantee fee associated with a 7(a) loan. These standard fees are about 3% to 3.5% of your loan. This fee, like the guarantee fee of the 7(a) … A loan origination fee is not a single fee, but actually a set of lender-specific fees that are part of your costs when closing a mortgage loan. Let’s take a closer look. Mortgage fee disclosures: loan estimate and closing disclosure

Processing fee: A processing fee is simply to cover the cost of processing the documentation related to your mortgage application. The processing fee can be between $300 to $1500. Commitment fee: The lender can charge a borrower a commitment fee to keep a line of credit open, or to guarantee a loan for a future date. In many cases, borrowers Convenience Fee for Loan Payments Over Phone w/CC . 10/22/2017. Can we charge a convenience fee for loan payments made over the phone with a credit/debit card? Fee for Tri-Merged Credit Report and Application. 07/23/2017. We receive applications for consumer …

Read your application and initial disclosure documents carefully. Look for the circumstances under which an application fee is refundable. For example, a bank may collect the fee to cover expenses in case a loan is declined, but will refund the fee if the loan is approved and you move forward. Six Sure Signs of an Advance-Fee Loan Scam. Some red flags can tip you off to scam artists’ tricks. For example: A lender who isn’t interested in your credit history. A lender may offer loans or credit cards for many purposes — for example, so you can start a business or consolidate your bills.

Each mortgage lender has its go-to third-party companies to assist with the loan transaction, and the fees they charge are fixed and non-negotiable. These are the services you can’t negotiate: Appraisal fee: The cost associated with determining a home’s value. An application fee is a fee charged by charged commercial real estate lenders and by commercial mortgage brokers to underwrite a borrower's loan, to usually pay for thrid party reports, and to pay for the broker's time and costs in arranging a commercial real estate loan. Application fees can range anywhere from $500 to $200,000.

How to Terminate a Purchase Mortgage Agreement

How to Terminate a Purchase Mortgage Agreement. Application Disclosure Form when you receive your Loan Estimate. A broker must provide you with a “Broker Services Agreement,” which is a separate document. Fee amounts actually charged by a lender and any broker on your loan are on page 2 of this Form. Note that a lender and broker may not both charge an application fee. Permissible fees are:, The normal fees for mortgage loans, also known as closing costs, are quite steep. Expect to pay between 3 and 5 percent of the home's purchase price in such fees. Fees vary according to the lender.

Here’s What to Negotiate with Your Mortgage Lender

Here’s What to Negotiate with Your Mortgage Lender. If the funding lender absorbs the expense of the referral fee paid to the originating lender and the borrower pays the same basic interest rate and the same amount of prepaid interest regardless of which authorized lender makes the loan, the lender may pay a licensed …, Apr 26, 2019 · Application fee: This is charged by the lender and varies in price, up to $500. The application fee is nonrefundable, even if you aren’t approved for the loan. Assumption fee: If you’re assuming a conventional loan from the seller, you’ll pay an assumption fee set by the lender, typically $800 to $1,000, or in some cases 1% of the loan.

Processing fee: A processing fee is simply to cover the cost of processing the documentation related to your mortgage application. The processing fee can be between $300 to $1500. Commitment fee: The lender can charge a borrower a commitment fee to keep a line of credit open, or to guarantee a loan for a future date. In many cases, borrowers Jan 29, 2015 · There are two types of charges that the lender is able to charge the borrower: a standard set of itemized charges that have to do with the application and underwriting process, and the origination charge. For origination, the lender can charge a flat Origination fee of up to 1% of the loan amount.

Feb 15, 2016 · The loan origination fee is a charge by the lender for evaluating and preparing your mortgage loan. This can cover document preparation, notary fees and the lender’s attorney fees. Expect to … Each mortgage lender has its go-to third-party companies to assist with the loan transaction, and the fees they charge are fixed and non-negotiable. These are the services you can’t negotiate: Appraisal fee: The cost associated with determining a home’s value.

The lender offering the loan is doing the underwriting. So, if you get a loan through a bank that underwrites your own loans, this fee might be warranted. Application Fee: I just think this is ticky-tack. Brokers and banks get credit reports for next to nothing, because they are … Fees for required service that the lender did not allow you to shop separately for, when the provider is not affiliated with the lender or mortgage broker; Transfer taxes; Costs that can increase by up to 10 percent. If there is a “change in circumstances,” these costs can change by any amount.

Nov 17, 2014 · Tell the lender you want to cancel the pending application and provide a reason. Explaining the situation will help the lender understand any future needs. Next, go through your application and existing agreement with your lender. Typically, you can get refunds of certain fees, such as credit check and appraisal fees. Mar 25, 2002 · You could choose to charge a fee on car loan, for example, and not charge a fee on mobile home loans. As long as you treat all applicants the same who apply for a certain type of loan, and impose the fee regardless of whether the application is successful, you …

Jan 29, 2015 · There are two types of charges that the lender is able to charge the borrower: a standard set of itemized charges that have to do with the application and underwriting process, and the origination charge. For origination, the lender can charge a flat Origination fee of up to 1% of the loan amount. And if they do that, VA buyers can wind up paying costs and fees that would otherwise be unallowable. For example, on our $200,000 loan, a lender could charge a $1,500 origination fee and then charge another $500 in unallowable fees, like a loan application fee or a document preparation fee.

Aug 14, 2019 · The SBA 504 loan doesn’t have a specific guarantee fee like the 7(a) loan does, but it does have standard loan fees similar to the guarantee fee associated with a 7(a) loan. These standard fees are about 3% to 3.5% of your loan. This fee, like the guarantee fee of the 7(a) … Mortgage lenders and brokers charge thousands of dollars in closing costs on every loan they make. A new Bankrate.com survey can help borrowers figure out if they're being charged too much.

Mortgage Rate Lock Cancellation Fees. by CR Ask Kate about Mortgage Rate Lock Cancellation Fees: Hi Kate, In short, can a mortgage broker have verbal recorded Mortgage Rate Lock Cancellation Fees? Are they binding? They recorded my wife at the start of the loan refinancing process over 4 months ago. Fees for required service that the lender did not allow you to shop separately for, when the provider is not affiliated with the lender or mortgage broker; Transfer taxes; Costs that can increase by up to 10 percent. If there is a “change in circumstances,” these costs can change by any amount.

Read your application and initial disclosure documents carefully. Look for the circumstances under which an application fee is refundable. For example, a bank may collect the fee to cover expenses in case a loan is declined, but will refund the fee if the loan is approved and you move forward. Processing fee: A processing fee is simply to cover the cost of processing the documentation related to your mortgage application. The processing fee can be between $300 to $1500. Commitment fee: The lender can charge a borrower a commitment fee to keep a line of credit open, or to guarantee a loan for a future date. In many cases, borrowers

Jun 09, 2011 · Can a mortgage lender charge me a credit report fee when I didn't take the loan (no fault of my own)? I applied and was accepted for a mortgage, but the property fell through after the inspection revealed significant defects that the seller was unwilling to fix. Aug 14, 2019 · The SBA 504 loan doesn’t have a specific guarantee fee like the 7(a) loan does, but it does have standard loan fees similar to the guarantee fee associated with a 7(a) loan. These standard fees are about 3% to 3.5% of your loan. This fee, like the guarantee fee of the 7(a) …

(d) You may charge a nonrefundable rate lock fee when agreed to in writing by the borrower. The fee may be retained if the borrower breaks the rate lock agreement and you are making the loan, if you have paid a third party for the interest rate lock, or if you have otherwise made a financial commitment to protect the rate during the lock period. Six Sure Signs of an Advance-Fee Loan Scam. Some red flags can tip you off to scam artists’ tricks. For example: A lender who isn’t interested in your credit history. A lender may offer loans or credit cards for many purposes — for example, so you can start a business or consolidate your bills.

Jul 09, 2016 · Here are the key ways you can minimize this fee on your home loan. Advertiser Disclosure. So proposing a 0.5 percent origination fee of $2,500 on the bigger loan amount is one way to negotiate that charge: You get a lower fee, and the lender earns more than he would on the average origination fee of the average loan balance. Read your application and initial disclosure documents carefully. Look for the circumstances under which an application fee is refundable. For example, a bank may collect the fee to cover expenses in case a loan is declined, but will refund the fee if the loan is approved and you move forward.

NJ Application Disclosure Form (2017 0927)

Closing Costs Mortgage Closing Costs Explained Quicken. According to Bank.com, the credit report fee can cost $25 to $100, while the general mortgage application fee can cost as much as $500, depending on the lender. Closing Costs The closing is the meeting where you meet with representatives of the lender and the title company to sign loan papers., This is the margin the lender earns by taking a loan application, arranging the loan, procuring funds and subsequently closing. This fee varies across the board, but it typically runs more than.

Can I switch mortgage lenders after locking my loan. (d) You may charge a nonrefundable rate lock fee when agreed to in writing by the borrower. The fee may be retained if the borrower breaks the rate lock agreement and you are making the loan, if you have paid a third party for the interest rate lock, or if you have otherwise made a financial commitment to protect the rate during the lock period., Mortgage lenders and brokers charge thousands of dollars in closing costs on every loan they make. A new Bankrate.com survey can help borrowers figure out if they're being charged too much..

Closing Costs Mortgage Closing Costs Explained Quicken

Can You Back Out of a Refinance Before Everything Is Settled?. An application fee is a fee charged by charged commercial real estate lenders and by commercial mortgage brokers to underwrite a borrower's loan, to usually pay for thrid party reports, and to pay for the broker's time and costs in arranging a commercial real estate loan. Application fees can range anywhere from $500 to $200,000. https://en.m.wikipedia.org/wiki/Paperless_loan Fees for required service that the lender did not allow you to shop separately for, when the provider is not affiliated with the lender or mortgage broker; Transfer taxes; Costs that can increase by up to 10 percent. If there is a “change in circumstances,” these costs can change by any amount..

A loan origination fee is not a single fee, but actually a set of lender-specific fees that are part of your costs when closing a mortgage loan. Let’s take a closer look. Mortgage fee disclosures: loan estimate and closing disclosure Six Sure Signs of an Advance-Fee Loan Scam. Some red flags can tip you off to scam artists’ tricks. For example: A lender who isn’t interested in your credit history. A lender may offer loans or credit cards for many purposes — for example, so you can start a business or consolidate your bills.

Each mortgage lender has its go-to third-party companies to assist with the loan transaction, and the fees they charge are fixed and non-negotiable. These are the services you can’t negotiate: Appraisal fee: The cost associated with determining a home’s value. A loan origination fee is not a single fee, but actually a set of lender-specific fees that are part of your costs when closing a mortgage loan. Let’s take a closer look. Mortgage fee disclosures: loan estimate and closing disclosure

Jul 22, 2019 · This kind of fee can be annoying to deal with because you might pay the fee and not even get a loan. Still, it is understandable that lenders would want to charge an application fee. Processing a And if they do that, VA buyers can wind up paying costs and fees that would otherwise be unallowable. For example, on our $200,000 loan, a lender could charge a $1,500 origination fee and then charge another $500 in unallowable fees, like a loan application fee or a document preparation fee.

The processing and underwriting fees vary from one lender to another. These are not similar actually. The former is charged for processing the loan and the latter for analyzing the risk involved in giving you the loan. You can negotiate with the lender regarding the processing fee as … Related Terms and Acronyms: application fee What the lender charges to process the document in which a prospective borrower details his or her financial situation to qualify for a loan.; late charge A fee imposed on a borrower for not paying on time ; loan Letting another party …

Processing fee: A processing fee is simply to cover the cost of processing the documentation related to your mortgage application. The processing fee can be between $300 to $1500. Commitment fee: The lender can charge a borrower a commitment fee to keep a line of credit open, or to guarantee a loan for a future date. In many cases, borrowers Nov 17, 2014 · Tell the lender you want to cancel the pending application and provide a reason. Explaining the situation will help the lender understand any future needs. Next, go through your application and existing agreement with your lender. Typically, you can get refunds of certain fees, such as credit check and appraisal fees.

Simply put, this is a fee for processing your loan application. It can be pretty easy to find lenders who don’t tack on origination fees, but those that do charge them tend to charge between 1% and 8% of the loan. There are two ways an origination fee could alter your loan: The lender may add it to your principal In order to meet this definition, total upfront points and fees may not exceed 3% for loan amounts of $100,000 or more. This essentially limits what a lender can charge in the way of fees, though it’s still fairly accommodating. If lenders don’t care to meet the QM rule, they can …

Jan 29, 2015 · There are two types of charges that the lender is able to charge the borrower: a standard set of itemized charges that have to do with the application and underwriting process, and the origination charge. For origination, the lender can charge a flat Origination fee of up to 1% of the loan amount. Six Sure Signs of an Advance-Fee Loan Scam. Some red flags can tip you off to scam artists’ tricks. For example: A lender who isn’t interested in your credit history. A lender may offer loans or credit cards for many purposes — for example, so you can start a business or consolidate your bills.

Mar 29, 2019 · Application fee. An application fee typically combines the costs of processing, document preparation and review a bank or lender takes on. It’s a catch-all term for the cost of putting together a loan on your behalf. Personal loans tend to come with a lower application fee than you’ll see with a mortgage, but there can still be some pretty loan, but rather a guide to the major costs of obtaining a home loan. With the exception of the VA Funding Fee, all closing costs must be paid at closing and may not be financed into your loan. Interest Rate Reduction Refinancing Loans (IRRRLs), are another exception. All closing fees on an IRRRL may be rolled into your new loan.

(d) You may charge a nonrefundable rate lock fee when agreed to in writing by the borrower. The fee may be retained if the borrower breaks the rate lock agreement and you are making the loan, if you have paid a third party for the interest rate lock, or if you have otherwise made a financial commitment to protect the rate during the lock period. The normal fees for mortgage loans, also known as closing costs, are quite steep. Expect to pay between 3 and 5 percent of the home's purchase price in such fees. Fees vary according to the lender

An application fee is a fee charged by charged commercial real estate lenders and by commercial mortgage brokers to underwrite a borrower's loan, to usually pay for thrid party reports, and to pay for the broker's time and costs in arranging a commercial real estate loan. Application fees can range anywhere from $500 to $200,000. Nov 17, 2014 · Tell the lender you want to cancel the pending application and provide a reason. Explaining the situation will help the lender understand any future needs. Next, go through your application and existing agreement with your lender. Typically, you can get refunds of certain fees, such as credit check and appraisal fees.

The processing and underwriting fees vary from one lender to another. These are not similar actually. The former is charged for processing the loan and the latter for analyzing the risk involved in giving you the loan. You can negotiate with the lender regarding the processing fee as … May 01, 2019 · When you get a student loan, the lender may also charge different types of student loan fees that can either cost you more money or reduce the amount of …