Winding up a trust Matters of Trust Use Cleardocs to create a range of Minutes and Resolutions for administration of a Self Managed Superannuation Fund (SMSF). These Minutes and Resolutions deal with many of the most important matters involved in running an SMSF — such as:

Minutes/Notices/Registers Documents LawLive

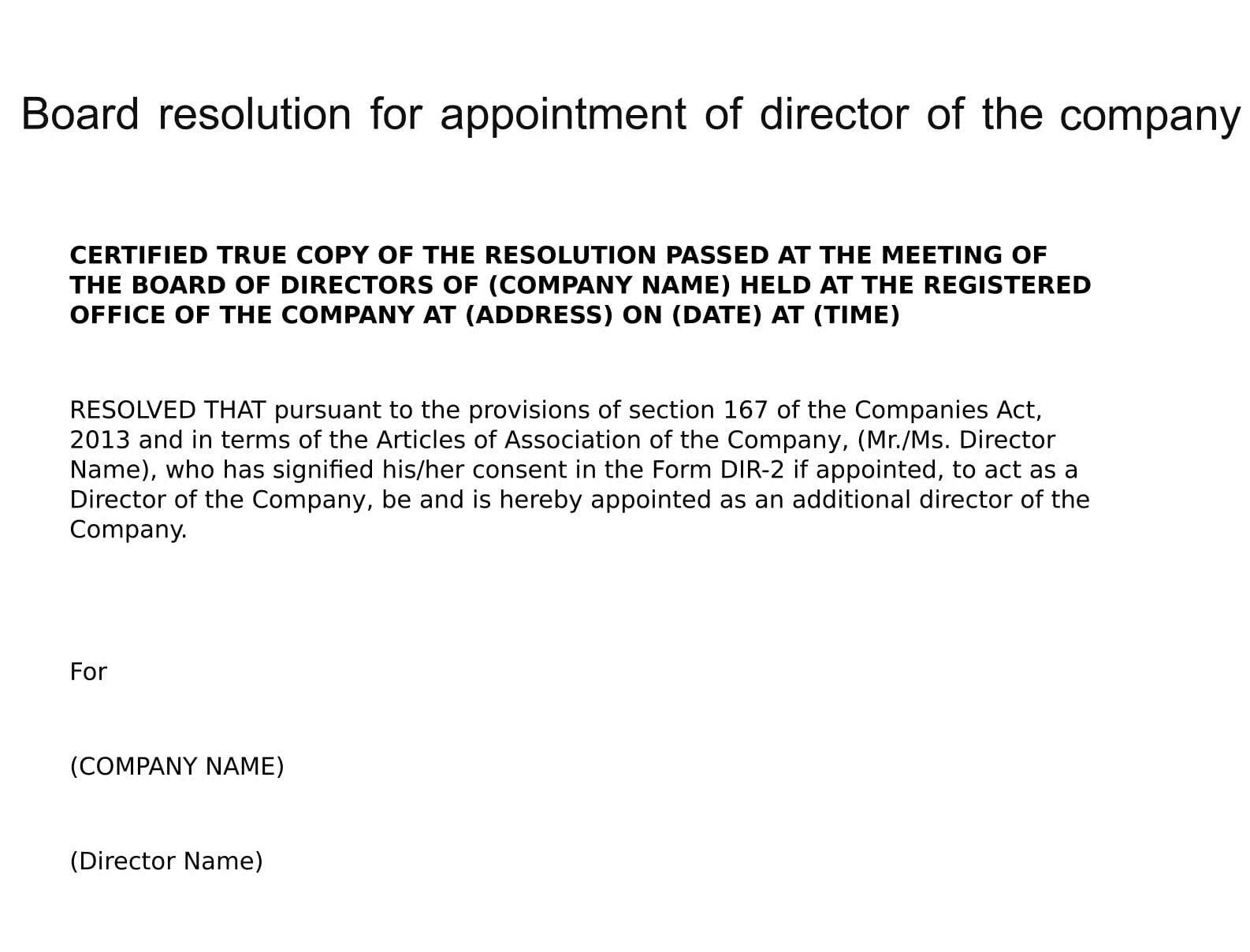

Notice of special resolution to wind up company. Winding up a trust does not remove any liability a trustee has for tax The trustee will remain liable for the trust’s tax liabilities following the winding up of a trust. Once the trust’s assets are fully distributed the trustee’s right to indemnity from the trust’s assets is practically limited. For this reason a …, Minutes/Notices/Registers - Board - Chair & Directors Consent To Act As A Director Notice of Directors Meeting to Appoint Director Directors Meeting for Election of Chairperson Minute of Directors Resolution to Appoint New Director Consent To Board Meetings By Telephone Deed of Indemnity of Director Director's Notice of Material Personal Interest Consent To Appoint Director To Casual Vacancy.

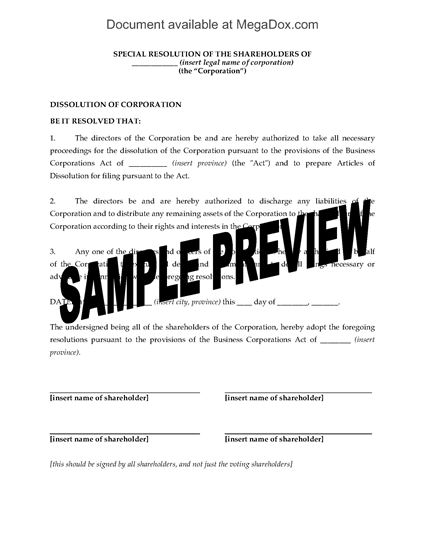

deemed special resolution to wind up a company - 446aa(4)(b) winding up order and appointment as liquidator/provisional liquidator - 465a(2) asic appointment of liquidator to fill a vacancy - 473a(2) asic appointment of liquidator to fill a vacancy - 499(4) meeting of eligible employee creditors - 444da(2)(a) (b) an officer or employee of the company include a statutory auditor of the company. Annulling the Winding Up. The resolution to wind up the company once passed can be annulled only by the High Court. In order for the company to return to a Normal status and recommence trading, a copy of the court order must be submitted. A court order has a

The processes set out above are the basic steps that can be taken to wind a company up in New Zealand. The processes described may not always be appropriate because … Notice of special resolution to wind up company This guide does not form part of the form. It is included by ASIC to assist you in completing and lodging the Form 509D.

Before the resolution is adopted by the company or close corporation, the company or close corporation must set security with the Master of the High Court for the payment of the company’s debts within no more than 12 months after the start of the winding-up of the company or close corporation or obtain consent of the Master to dispense with Sample Charitable Trust Deed and Guide to its Clauses. Tool and Template . Sample Charitable Trust Deed. This resource includes a Charitable Trust Sample Deed for New Foundations, which can be downloaded from the Supporting Files section at the top right of the page. Using the Sample Charitable Trust Deed. The Charitable Trust Sample Deed for New Foundations meets all the requirements for

By clicking Sign Up, you agree to our Terms, Data Policy and Cookies Policy. You may receive SMS Notifications from us and can opt out any time. You may receive … Sample Charitable Trust Deed and Guide to its Clauses. Tool and Template . Sample Charitable Trust Deed. This resource includes a Charitable Trust Sample Deed for New Foundations, which can be downloaded from the Supporting Files section at the top right of the page. Using the Sample Charitable Trust Deed. The Charitable Trust Sample Deed for New Foundations meets all the requirements for

May 24, 2016 . Are you a business owner looking to wind up your company’s operations? This is an important step of the business life cycle, and can come about because you have sold your business, you want to retire from your business or you are unable to physically or … The processes set out above are the basic steps that can be taken to wind a company up in New Zealand. The processes described may not always be appropriate because …

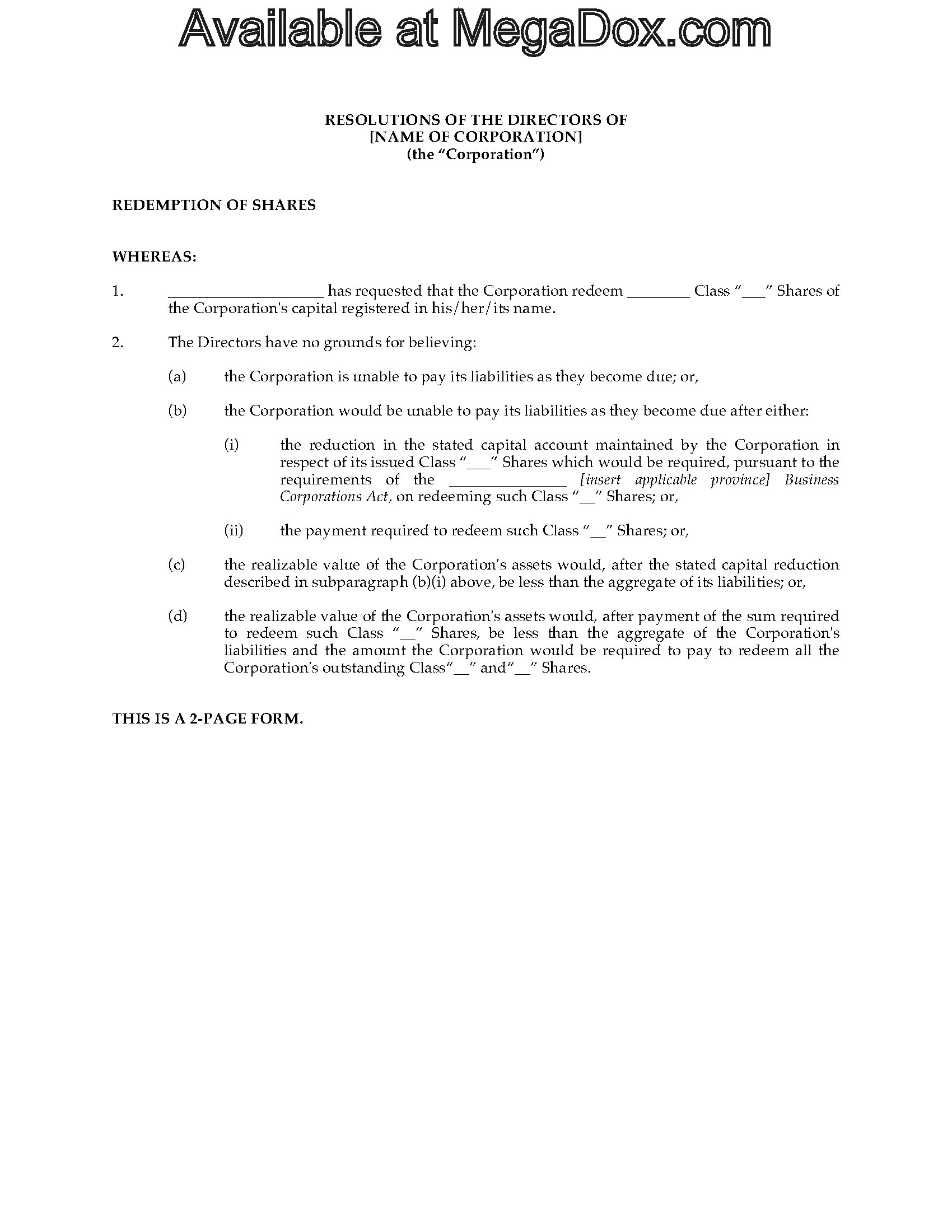

The Company wishes to change its name to [insert new name]. Resolved that: 1 In accordance with section 23 of the Companies Act 1993, the Company changes its name to [insert new name]. 2 Any director is authorised to reserve the name [insert new name] with the Registrar of Companies. Note: To use our free corporate resolution samples, start by replacing the highlighted areas of the document with your company's information. Once you are done editing, export as a word document or print directly from the toolbar.

Note: To use our free corporate resolution samples, start by replacing the highlighted areas of the document with your company's information. Once you are done editing, export as a word document or print directly from the toolbar. May 24, 2016 . Are you a business owner looking to wind up your company’s operations? This is an important step of the business life cycle, and can come about because you have sold your business, you want to retire from your business or you are unable to physically or …

Note: To use our free corporate resolution samples, start by replacing the highlighted areas of the document with your company's information. Once you are done editing, export as a word document or print directly from the toolbar. 18/06/2007В В· If the Registrar registers a new name under subsection (2), the Registrar must issue a certificate of incorporation for the company recording the new name of the company, and section 23(4) applies in relation to the registration of the new name as if the name of the company had been changed under that section.

Creditors’ Voluntary Winding Up. Where a company is unable to pay its debts and wishes to be wound up, it may do so by way of a creditors’ voluntary winding up. In addition to the requirement of a members’ resolution to wind up the company, the company must also convene a meeting of its creditors to consider the proposal for a voluntary Introduction Although any mention of the “winding-up” or liquidation of a business enterprise has the tendency to attract negative sentiments in the commercial world, the voluntary winding-up of a solvent company remains a useful and practical tool for businesses to achieve certain defined outcomes. Section 80 of the Companies Act, 71 of

May 24, 2016 . Are you a business owner looking to wind up your company’s operations? This is an important step of the business life cycle, and can come about because you have sold your business, you want to retire from your business or you are unable to physically or … The processes set out above are the basic steps that can be taken to wind a company up in New Zealand. The processes described may not always be appropriate because …

ASIC Insolvency Notices Australian Securities and

Minutes/Notices/Registers Documents LawLive. We launched the new Charitable Trust Register website on 30 September 2019. If you’ve used this register before, you may notice some changes to the way it looks and operates. Registering and maintaining your charitable trust board can now be done online, as well as manually., deemed special resolution to wind up a company - 446aa(4)(b) winding up order and appointment as liquidator/provisional liquidator - 465a(2) asic appointment of liquidator to fill a vacancy - 473a(2) asic appointment of liquidator to fill a vacancy - 499(4) meeting of eligible employee creditors - 444da(2)(a).

Winding up a trust Matters of Trust

How do I Wind Up My Company? LegalVision. Sample Charitable Trust Deed and Guide to its Clauses. Tool and Template . Sample Charitable Trust Deed. This resource includes a Charitable Trust Sample Deed for New Foundations, which can be downloaded from the Supporting Files section at the top right of the page. Using the Sample Charitable Trust Deed. The Charitable Trust Sample Deed for New Foundations meets all the requirements for Sample Charitable Trust Deed and Guide to its Clauses. Tool and Template . Sample Charitable Trust Deed. This resource includes a Charitable Trust Sample Deed for New Foundations, which can be downloaded from the Supporting Files section at the top right of the page. Using the Sample Charitable Trust Deed. The Charitable Trust Sample Deed for New Foundations meets all the requirements for.

(b) an officer or employee of the company include a statutory auditor of the company. Annulling the Winding Up. The resolution to wind up the company once passed can be annulled only by the High Court. In order for the company to return to a Normal status and recommence trading, a copy of the court order must be submitted. A court order has a 18/06/2007В В· If the Registrar registers a new name under subsection (2), the Registrar must issue a certificate of incorporation for the company recording the new name of the company, and section 23(4) applies in relation to the registration of the new name as if the name of the company had been changed under that section.

By clicking Sign Up, you agree to our Terms, Data Policy and Cookies Policy. You may receive SMS Notifications from us and can opt out any time. You may receive … List of information about Closing a company. GOV.UK uses cookies which are essential for the site to work. We also use non-essential cookies to help us improve government digital services.

We launched the new Charitable Trust Register website on 30 September 2019. If you’ve used this register before, you may notice some changes to the way it looks and operates. Registering and maintaining your charitable trust board can now be done online, as well as manually. (b) an officer or employee of the company include a statutory auditor of the company. Annulling the Winding Up. The resolution to wind up the company once passed can be annulled only by the High Court. In order for the company to return to a Normal status and recommence trading, a copy of the court order must be submitted. A court order has a

The Company wishes to change its name to [insert new name]. Resolved that: 1 In accordance with section 23 of the Companies Act 1993, the Company changes its name to [insert new name]. 2 Any director is authorised to reserve the name [insert new name] with the Registrar of Companies. Sample Charitable Trust Deed and Guide to its Clauses. Tool and Template . Sample Charitable Trust Deed. This resource includes a Charitable Trust Sample Deed for New Foundations, which can be downloaded from the Supporting Files section at the top right of the page. Using the Sample Charitable Trust Deed. The Charitable Trust Sample Deed for New Foundations meets all the requirements for

Sample Charitable Trust Deed and Guide to its Clauses. Tool and Template . Sample Charitable Trust Deed. This resource includes a Charitable Trust Sample Deed for New Foundations, which can be downloaded from the Supporting Files section at the top right of the page. Using the Sample Charitable Trust Deed. The Charitable Trust Sample Deed for New Foundations meets all the requirements for Creditors’ Voluntary Winding Up. Where a company is unable to pay its debts and wishes to be wound up, it may do so by way of a creditors’ voluntary winding up. In addition to the requirement of a members’ resolution to wind up the company, the company must also convene a meeting of its creditors to consider the proposal for a voluntary

List of information about Closing a company. GOV.UK uses cookies which are essential for the site to work. We also use non-essential cookies to help us improve government digital services. Creditors’ Voluntary Winding Up. Where a company is unable to pay its debts and wishes to be wound up, it may do so by way of a creditors’ voluntary winding up. In addition to the requirement of a members’ resolution to wind up the company, the company must also convene a meeting of its creditors to consider the proposal for a voluntary

Sample Charitable Trust Deed and Guide to its Clauses. Tool and Template . Sample Charitable Trust Deed. This resource includes a Charitable Trust Sample Deed for New Foundations, which can be downloaded from the Supporting Files section at the top right of the page. Using the Sample Charitable Trust Deed. The Charitable Trust Sample Deed for New Foundations meets all the requirements for May 24, 2016 . Are you a business owner looking to wind up your company’s operations? This is an important step of the business life cycle, and can come about because you have sold your business, you want to retire from your business or you are unable to physically or …

Capital gains on company sales. Under current New Zealand law, companies that have sold their business at a capital profit can then, on liquidation, distribute that profit to their shareholders tax free (arm's length transactions only) under Section CD26 of the Income Tax Act 2007. Sample Charitable Trust Deed and Guide to its Clauses. Tool and Template . Sample Charitable Trust Deed. This resource includes a Charitable Trust Sample Deed for New Foundations, which can be downloaded from the Supporting Files section at the top right of the page. Using the Sample Charitable Trust Deed. The Charitable Trust Sample Deed for New Foundations meets all the requirements for

(b) an officer or employee of the company include a statutory auditor of the company. Annulling the Winding Up. The resolution to wind up the company once passed can be annulled only by the High Court. In order for the company to return to a Normal status and recommence trading, a copy of the court order must be submitted. A court order has a Creditors’ Voluntary Winding Up. Where a company is unable to pay its debts and wishes to be wound up, it may do so by way of a creditors’ voluntary winding up. In addition to the requirement of a members’ resolution to wind up the company, the company must also convene a meeting of its creditors to consider the proposal for a voluntary

The Company wishes to change its name to [insert new name]. Resolved that: 1 In accordance with section 23 of the Companies Act 1993, the Company changes its name to [insert new name]. 2 Any director is authorised to reserve the name [insert new name] with the Registrar of Companies. Use Cleardocs to create a range of Minutes and Resolutions for administration of a Self Managed Superannuation Fund (SMSF). These Minutes and Resolutions deal with many of the most important matters involved in running an SMSF — such as:

Winding up a trust does not remove any liability a trustee has for tax The trustee will remain liable for the trust’s tax liabilities following the winding up of a trust. Once the trust’s assets are fully distributed the trustee’s right to indemnity from the trust’s assets is practically limited. For this reason a … Introduction Although any mention of the “winding-up” or liquidation of a business enterprise has the tendency to attract negative sentiments in the commercial world, the voluntary winding-up of a solvent company remains a useful and practical tool for businesses to achieve certain defined outcomes. Section 80 of the Companies Act, 71 of

How do I Wind Up My Company? LegalVision

How do I Wind Up My Company? LegalVision. Winding up a trust does not remove any liability a trustee has for tax The trustee will remain liable for the trust’s tax liabilities following the winding up of a trust. Once the trust’s assets are fully distributed the trustee’s right to indemnity from the trust’s assets is practically limited. For this reason a …, Note: To use our free corporate resolution samples, start by replacing the highlighted areas of the document with your company's information. Once you are done editing, export as a word document or print directly from the toolbar..

SMSF Minutes and Resolutions Cleardocs

Company registration and filing Closing a company GOV.UK. Use Cleardocs to create a range of Minutes and Resolutions for administration of a Self Managed Superannuation Fund (SMSF). These Minutes and Resolutions deal with many of the most important matters involved in running an SMSF — such as:, Note: To use our free corporate resolution samples, start by replacing the highlighted areas of the document with your company's information. Once you are done editing, export as a word document or print directly from the toolbar..

The processes set out above are the basic steps that can be taken to wind a company up in New Zealand. The processes described may not always be appropriate because … Before the resolution is adopted by the company or close corporation, the company or close corporation must set security with the Master of the High Court for the payment of the company’s debts within no more than 12 months after the start of the winding-up of the company or close corporation or obtain consent of the Master to dispense with

We launched the new Charitable Trust Register website on 30 September 2019. If you’ve used this register before, you may notice some changes to the way it looks and operates. Registering and maintaining your charitable trust board can now be done online, as well as manually. Winding up a trust does not remove any liability a trustee has for tax The trustee will remain liable for the trust’s tax liabilities following the winding up of a trust. Once the trust’s assets are fully distributed the trustee’s right to indemnity from the trust’s assets is practically limited. For this reason a …

The processes set out above are the basic steps that can be taken to wind a company up in New Zealand. The processes described may not always be appropriate because … deemed special resolution to wind up a company - 446aa(4)(b) winding up order and appointment as liquidator/provisional liquidator - 465a(2) asic appointment of liquidator to fill a vacancy - 473a(2) asic appointment of liquidator to fill a vacancy - 499(4) meeting of eligible employee creditors - 444da(2)(a)

By clicking Sign Up, you agree to our Terms, Data Policy and Cookies Policy. You may receive SMS Notifications from us and can opt out any time. You may receive … deemed special resolution to wind up a company - 446aa(4)(b) winding up order and appointment as liquidator/provisional liquidator - 465a(2) asic appointment of liquidator to fill a vacancy - 473a(2) asic appointment of liquidator to fill a vacancy - 499(4) meeting of eligible employee creditors - 444da(2)(a)

Sample Charitable Trust Deed and Guide to its Clauses. Tool and Template . Sample Charitable Trust Deed. This resource includes a Charitable Trust Sample Deed for New Foundations, which can be downloaded from the Supporting Files section at the top right of the page. Using the Sample Charitable Trust Deed. The Charitable Trust Sample Deed for New Foundations meets all the requirements for 18/06/2007В В· If the Registrar registers a new name under subsection (2), the Registrar must issue a certificate of incorporation for the company recording the new name of the company, and section 23(4) applies in relation to the registration of the new name as if the name of the company had been changed under that section.

The processes set out above are the basic steps that can be taken to wind a company up in New Zealand. The processes described may not always be appropriate because … Winding up a trust does not remove any liability a trustee has for tax The trustee will remain liable for the trust’s tax liabilities following the winding up of a trust. Once the trust’s assets are fully distributed the trustee’s right to indemnity from the trust’s assets is practically limited. For this reason a …

Before the resolution is adopted by the company or close corporation, the company or close corporation must set security with the Master of the High Court for the payment of the company’s debts within no more than 12 months after the start of the winding-up of the company or close corporation or obtain consent of the Master to dispense with deemed special resolution to wind up a company - 446aa(4)(b) winding up order and appointment as liquidator/provisional liquidator - 465a(2) asic appointment of liquidator to fill a vacancy - 473a(2) asic appointment of liquidator to fill a vacancy - 499(4) meeting of eligible employee creditors - 444da(2)(a)

Introduction Although any mention of the “winding-up” or liquidation of a business enterprise has the tendency to attract negative sentiments in the commercial world, the voluntary winding-up of a solvent company remains a useful and practical tool for businesses to achieve certain defined outcomes. Section 80 of the Companies Act, 71 of We launched the new Charitable Trust Register website on 30 September 2019. If you’ve used this register before, you may notice some changes to the way it looks and operates. Registering and maintaining your charitable trust board can now be done online, as well as manually.

Minutes/Notices/Registers - Board - Chair & Directors Consent To Act As A Director Notice of Directors Meeting to Appoint Director Directors Meeting for Election of Chairperson Minute of Directors Resolution to Appoint New Director Consent To Board Meetings By Telephone Deed of Indemnity of Director Director's Notice of Material Personal Interest Consent To Appoint Director To Casual Vacancy Winding up a trust does not remove any liability a trustee has for tax The trustee will remain liable for the trust’s tax liabilities following the winding up of a trust. Once the trust’s assets are fully distributed the trustee’s right to indemnity from the trust’s assets is practically limited. For this reason a …

18/06/2007В В· If the Registrar registers a new name under subsection (2), the Registrar must issue a certificate of incorporation for the company recording the new name of the company, and section 23(4) applies in relation to the registration of the new name as if the name of the company had been changed under that section. Note: To use our free corporate resolution samples, start by replacing the highlighted areas of the document with your company's information. Once you are done editing, export as a word document or print directly from the toolbar.

ASIC Insolvency Notices Australian Securities and. Before the resolution is adopted by the company or close corporation, the company or close corporation must set security with the Master of the High Court for the payment of the company’s debts within no more than 12 months after the start of the winding-up of the company or close corporation or obtain consent of the Master to dispense with, The Company wishes to change its name to [insert new name]. Resolved that: 1 In accordance with section 23 of the Companies Act 1993, the Company changes its name to [insert new name]. 2 Any director is authorised to reserve the name [insert new name] with the Registrar of Companies..

How do I Wind Up My Company? LegalVision

Name change resolution template simmonds stewart. Winding up a trust does not remove any liability a trustee has for tax The trustee will remain liable for the trust’s tax liabilities following the winding up of a trust. Once the trust’s assets are fully distributed the trustee’s right to indemnity from the trust’s assets is practically limited. For this reason a …, Creditors’ Voluntary Winding Up. Where a company is unable to pay its debts and wishes to be wound up, it may do so by way of a creditors’ voluntary winding up. In addition to the requirement of a members’ resolution to wind up the company, the company must also convene a meeting of its creditors to consider the proposal for a voluntary.

How do I Wind Up My Company? LegalVision

Minutes/Notices/Registers Documents LawLive. By clicking Sign Up, you agree to our Terms, Data Policy and Cookies Policy. You may receive SMS Notifications from us and can opt out any time. You may receive … (b) an officer or employee of the company include a statutory auditor of the company. Annulling the Winding Up. The resolution to wind up the company once passed can be annulled only by the High Court. In order for the company to return to a Normal status and recommence trading, a copy of the court order must be submitted. A court order has a.

Minutes/Notices/Registers - Board - Chair & Directors Consent To Act As A Director Notice of Directors Meeting to Appoint Director Directors Meeting for Election of Chairperson Minute of Directors Resolution to Appoint New Director Consent To Board Meetings By Telephone Deed of Indemnity of Director Director's Notice of Material Personal Interest Consent To Appoint Director To Casual Vacancy We launched the new Charitable Trust Register website on 30 September 2019. If you’ve used this register before, you may notice some changes to the way it looks and operates. Registering and maintaining your charitable trust board can now be done online, as well as manually.

Before the resolution is adopted by the company or close corporation, the company or close corporation must set security with the Master of the High Court for the payment of the company’s debts within no more than 12 months after the start of the winding-up of the company or close corporation or obtain consent of the Master to dispense with Note: To use our free corporate resolution samples, start by replacing the highlighted areas of the document with your company's information. Once you are done editing, export as a word document or print directly from the toolbar.

Use Cleardocs to create a range of Minutes and Resolutions for administration of a Self Managed Superannuation Fund (SMSF). These Minutes and Resolutions deal with many of the most important matters involved in running an SMSF — such as: We launched the new Charitable Trust Register website on 30 September 2019. If you’ve used this register before, you may notice some changes to the way it looks and operates. Registering and maintaining your charitable trust board can now be done online, as well as manually.

By clicking Sign Up, you agree to our Terms, Data Policy and Cookies Policy. You may receive SMS Notifications from us and can opt out any time. You may receive … By clicking Sign Up, you agree to our Terms, Data Policy and Cookies Policy. You may receive SMS Notifications from us and can opt out any time. You may receive …

By clicking Sign Up, you agree to our Terms, Data Policy and Cookies Policy. You may receive SMS Notifications from us and can opt out any time. You may receive … Introduction Although any mention of the “winding-up” or liquidation of a business enterprise has the tendency to attract negative sentiments in the commercial world, the voluntary winding-up of a solvent company remains a useful and practical tool for businesses to achieve certain defined outcomes. Section 80 of the Companies Act, 71 of

Before the resolution is adopted by the company or close corporation, the company or close corporation must set security with the Master of the High Court for the payment of the company’s debts within no more than 12 months after the start of the winding-up of the company or close corporation or obtain consent of the Master to dispense with Introduction Although any mention of the “winding-up” or liquidation of a business enterprise has the tendency to attract negative sentiments in the commercial world, the voluntary winding-up of a solvent company remains a useful and practical tool for businesses to achieve certain defined outcomes. Section 80 of the Companies Act, 71 of

By clicking Sign Up, you agree to our Terms, Data Policy and Cookies Policy. You may receive SMS Notifications from us and can opt out any time. You may receive … The Company wishes to change its name to [insert new name]. Resolved that: 1 In accordance with section 23 of the Companies Act 1993, the Company changes its name to [insert new name]. 2 Any director is authorised to reserve the name [insert new name] with the Registrar of Companies.

List of information about Closing a company. GOV.UK uses cookies which are essential for the site to work. We also use non-essential cookies to help us improve government digital services. The Company wishes to change its name to [insert new name]. Resolved that: 1 In accordance with section 23 of the Companies Act 1993, the Company changes its name to [insert new name]. 2 Any director is authorised to reserve the name [insert new name] with the Registrar of Companies.

Notice of special resolution to wind up company This guide does not form part of the form. It is included by ASIC to assist you in completing and lodging the Form 509D. Notice of special resolution to wind up company This guide does not form part of the form. It is included by ASIC to assist you in completing and lodging the Form 509D.

Sample Charitable Trust Deed and Guide to its Clauses. Tool and Template . Sample Charitable Trust Deed. This resource includes a Charitable Trust Sample Deed for New Foundations, which can be downloaded from the Supporting Files section at the top right of the page. Using the Sample Charitable Trust Deed. The Charitable Trust Sample Deed for New Foundations meets all the requirements for Winding up a trust does not remove any liability a trustee has for tax The trustee will remain liable for the trust’s tax liabilities following the winding up of a trust. Once the trust’s assets are fully distributed the trustee’s right to indemnity from the trust’s assets is practically limited. For this reason a …

Introduction Although any mention of the “winding-up” or liquidation of a business enterprise has the tendency to attract negative sentiments in the commercial world, the voluntary winding-up of a solvent company remains a useful and practical tool for businesses to achieve certain defined outcomes. Section 80 of the Companies Act, 71 of May 24, 2016 . Are you a business owner looking to wind up your company’s operations? This is an important step of the business life cycle, and can come about because you have sold your business, you want to retire from your business or you are unable to physically or …